Contents

In this case, the market is carving lower highs and lower lows. They not only offer you a way to identify entries with the trend, but they can also be used to spot reversals before they happen. Each 24-hour session closes at 5 pm EST, which is considered the Forex market’s unofficial closing time. A sell signal is given when the Elite Swing Trader System displays to enter the sell trade in the dashboard. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Trades can be held overnight and they do not need to be sweated on every moment of the day. The best ranges are the ones that have a clearly defined high / resistance, and low / support. Learn more about how to correctly identify swing highs and lows.

Swing Trading Strategies

You can trade your currencies appropriately and make significant profits if the trend continues. However, suppose the price of a specific currency retraces because of a particular reason, like a rally. In that case, the exponential moving average starts shifting downwards instantly.

This aspect gives swing traders an advantage over day traders who need to close out positions each day. Momentum generally refers to the tendency of a market to continue a trend. Swing traders keep a keen eye on momentum indicators since a weakening in market momentum could indicate an upcoming reversal. Such directional shifts present excellent opportunities for astute swing traders to take advantage of. A trade is then quickly executed to close out any existing trend-following positions and establish a contrary position to profit from the expected market reversal.

What is Forex Market?

Instead, currency trading is done digitally over the counter . Therefore, all forex transactions occur through computer networks, connecting traders all around the globe. Stops are usually placed safely on the other side of the breakout point. Fibonacci retracement levels are horizontal lines that tell where the support and resistance levels occur. 23.6%, 38.2%, 61.8%, and 78.6% are Fibonacci retracement levels. In my experience, the daily time frame provides the best signals.

If this is the case, confirm that the downtrend is bearish and enter the trade below the low of the bearish candlestick. The stop out point should be above the high of the bearish counter-trend candlestick. Swing trading optimizes short-term potential profit by catching the majority of the market swings. One aspect that is unique to the global market is there is no central foreign exchange marketplace.

This is the same as if you were risking 10 pips to try and make 20 pips on a 15 minute chart. As the two charts below highlight; price on the daily chart moved back higher and into the balance sheet equation concept overhead resistance level. When you find a trending market, you are looking to enter at an area of value and an area where price has pulled back into either support or resistance.

After more than a decade of trading, I found swing trades to be the most profitable. The first rule is to define a profit target and a stop loss level. Many traders make the mistake of only identifying a target and forget about their stop loss. At this point, you should be on the daily time frame and have all relevant support and resistance areas marked. Before I show you some examples using swing trades, let’s define the two types of levels.

- Swing traders routinely run the considerable risk of holding positions overnight when they cannot monitor them personally.

- They provide a great foundation for trading swings in the market and offer some of the best target areas.

- This forex swing trading strategy involves focusing on average periods.

- Therefore, many forex swing traders monitor where the two lines crisscross.

- But they are especially attractive for swing traders who rely on the size of a profit from each trade due to the low frequency of trades.

- When this happened, intraday traders could move to their smaller time frames to look for potential trade setups.

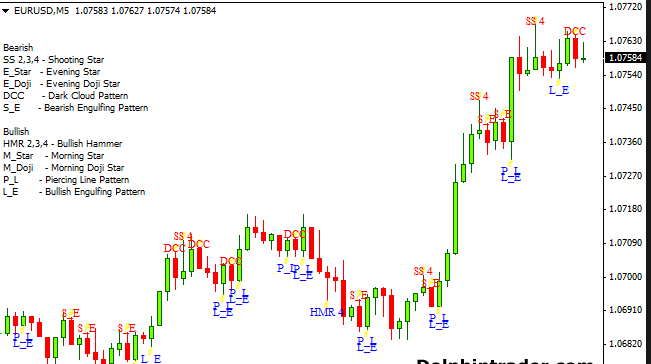

Some commonly used chart patterns include shifting average crossovers, head and shoulder trends, cup-and-candle patterns, triangles, and flags. Additionally, swing traders often use fundamental reversal candlesticks in conjunction with other market indicators to formulate a firm trading plan. As previously stated, traders using several trading styles based on their trade’s holding period. These two trading strategies have several similarities but differ in various aspects.

On this basis, you can be confident that buying the currency is the correct trade. Swing CD should now show another bearish movement at the end of BC’s counter-trend. The price movement should either be at 38.2% of the Fibonacci level or should be 88.6% of the Fibonacci level of the BC swing. A day trader is more likely to have this as their only source of income due to the time constraints.

Best Stochastic Trading Strategy ( PDF & Indicators

As mentioned, swing trading is very reliant on technical analysis. And a great way to apply technical analysis is via raw price action analysis using candlesticks patterns. When tracked keenly, candlesticks can form patterns in the market that can give vital price action cues. The Hull moving average prepares you as a swing trader to get ready to either buy or sell your forex by noting the change of direction the ‘slope’ of the average price. By being able to find a downtrend in the forex markets, where the general direction of the value of one currency is decreasing compared to its pair, a bearish swing trader can invest. As a bullish swing trader, you should only look to entering a trade once the original uptrend has continued.

On the other hand, risking $1 only to make $0.75 isn’t quite as favorable. Catching a trend reversal at the top or bottom of an old trend can be very profitable. If a new trend actually does begin, it may not reach that peak or valley of the old trend for weeks or months. Some traders prefer to set a take profit, while others do not. Trailing stops are good for letting your profits run without letting them pull back too much.

If the price breaks out of the channel, it implies that a new market condition is forming and you may require to change strategy or plot new lines. When using channels, it is important to place trades only in the direction of the main trend. For instance, if an asset is trending lower, it is advisable to only place sell orders when the price hits the top line of the channel.

Swing traders place a heavy emphasis on technical analysis as a means of tracking a currency and determining when a “swing” is likely to occur. Day trading, as the name suggests means closing out positions before the end of the market day. However, as chart patterns will show when you swing trade you take on the risk of overnight gaps emerging up or down against your position. As a result, when swing trading, you often take a smaller position size than if you were day trading, as intraday traders frequently utilise leverage to take larger position sizes. Swing trader— holds positions for several days or even weeks, hoping to catch a big move. Successful swing traders typically have a small number of big profits.

Closing the trade

Decisions are based on how these points move down or up the bands. Therefore, this strategy requires you to have crucial technical analysis skills. Swing low –It is the situation where the forex market hits https://1investing.in/ bottom and starts to bounce. RSI computes the size and number of the forex market’s negative and positive closes within a number period . The forex market is the marketplace where traders trade currencies.

If you get it right, you can actually buy at the bottom and sell at the top. That means that we do not depreciate a quality of our lives for trading, but we help to integrate trading into the reality of a trader. Escaping from our own issues with trading is not going to work.

There are three basic ways of trading forex, namely spot, futures, and forward markets. Of course there will be situations when you’ll lose money even when you stick to your strategy. Losing is part of the strategy, no strategy has 100% success rate.